Quote – “Gold is money. Everything else is credit.” JP Morgan, 1912

It would be hard not to have noticed the extraordinary rise in the price of gold in recent years (Chart A). For the entire span of human history, it took thousands of years for the price to break U$1000/oz (2009), then only 11 years to break U$2000/oz, (Aug 2020), and now, just a few more to smash through the U$3,000/oz barrier (March 2025).

Explaining why the price of gold has surged recently is just as much about art as it is a science, but we can endeavour to highlight a number of key drivers.

For instance, gold offers certainty in an uncertain world, and the world definitely feels uncertain at this specific moment in time. For investors, it has often been the ultimate store of value, as well as being the uncorrelated asset of choice when the ‘black swans’ are in flight. In recent years, we have seen a rally in the price of gold, both as a store of value in times of crisis (2020), and as a hedge against the corrosive effects of inflation (2023). Yet clearly other factors are afoot, given the huge surge that we have witnessed in just over a year.

One factor of this surge is that central banks have significantly increased their purchases, particularly during 2022 and specifically China and Japan, which have had chronically low levels of gold as a percentage of their

reserves. Chinese consumers, increasingly pessimistic in their investment sentiment, as well as lacking access to many global financial instruments, have also been adding to domestic inventories. Another factor is the huge explosion in global debt levels, particularly in the US, which many see as a sign of profligate western governments debasing money, has generated further interest in gold as a store of value.

More recently we have seen the new US administration challenge long established structures around security, defence, and trade, all of which adds to the alure of gold in an increasingly uncertain world. At the same time, these very factors also diminish the outlook for the US dollar and US treasuries as safe haven assets, which increases the appeal of gold in turn.

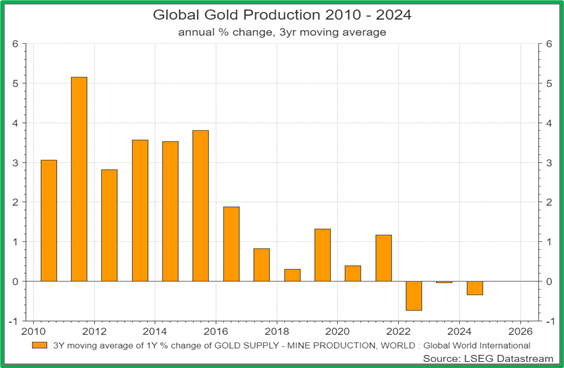

And whilst this demand has ballooned, the supply of gold has remained fairly subdued, with global production peaking in 2019. In fact, the annual change in global gold production as a percentage continues to be negative (Chart B). The old adage that ‘the cure for high prices is high prices’ doesn’t seem to apply here. Gold can sometimes be a ‘Giffen good’ – a product that defies standard economic and consumer demand theory – in which supply cannot simply respond in any meaningful way to higher prices. Gold mines are incredibly difficult to start, for all of the easiest ore bodies have been mined already, and new potential sites are often fraught with political, geological, logistical and environmental difficulties.

For investors, gaining exposure to physical gold is not always straightforward. Indeed, even those funds which often claim to have gold bullion exposure are usually only able to provide a limited, underlying exposure to the ‘yellow metal’.

For practical reasons, gold exposure is often more easily achieved, indirectly, by investing in the equities of ‘gold miners’. The challenge, unfortunately, is that gold and gold miners can have very different performance drivers, and radically different returns sometimes.

This was the case (and the opportunity) when Collidr reintroduced gold mining exposure to portfolios in December 2023, via the BlackRock Gold and General fund, to complement existing holdings with exposure to physical gold already held in the defensive component (Chart D).

Back then, gold had reached the dizzy heights of U$2000/oz, but gold miners remained out of favour, reflecting a lack of conviction over the sustainability of the price of gold perhaps (not something our signals shared), plus the hangover off a very challenging 2022 for the sector. Since then, gold has continued to power ahead, but so have gold miners. Despite the huge rally in gold since December 2023, gold miners have kept pace, clocking in a near 60% rally (Chart D).

What the holding in BlackRock Gold and General has given us, apart from an excellent return, is a really strong source of differentiated return, particularly in recent months (Chart E).

One of the questions we get is why didn’t we have a bigger allocation to Blackrock Gold and General? There’s obviously a lot of hindsight benefit in that observation, and even when you try to remove this hindsight bias, it’s almost impossible to do so. One factor behind the allocation decision is the structurally higher volatility that we experience in this fund (Chart F). Gold Miners are very volatile, reflecting the inherent volatility of the price of gold itself, the highly concentrated nature of the sector, and the timing difference between a US dominated sector and a London preceding-day, noon-priced fund. Whilst not the only factor, this structurally elevated volatility is a consideration in the model optimisation process.

This is not the only way that gold exposure can be introduced into the models. In the defensive components, we can allocate to funds such as Ruffer Diversified. The Ruffer fund brings a lot of specific exposures to the portfolio, one of which is gold via direct bullion exposure, as well as gold mining equities. As of March 2025, around 10% of the Ruffer fund was exposed to gold and other precious metals.

So the 24-carat question, if you’ll pardon the pun, is could this period of significant absolute and relative outperformance for gold miners be coming to an end? Is it already priced in?

Clearly a major factor is the price of gold itself. In the short term, this will be the primary factor determining sector performance. Whilst predicting short term moves in the price of gold can sometimes feel as scientific as palm reading, perhaps ask yourself these simple questions? One, will the current political environment (and international relations) become any calmer and more predictable soon? Two, are governments going to rediscover the virtues of fiscal discipline and stable economic growth? If the answer to both is no, then it’s not unreasonable to assume that the price of gold is likely to remain elevated.

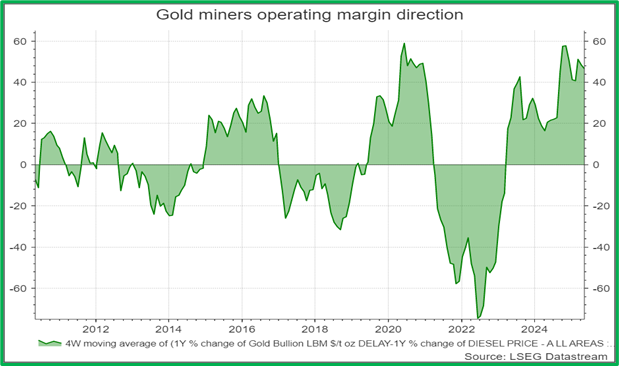

But there are also other reasons for remaining structurally bullish. Another factor is the recovery in operating margins across this sector. At times, analysing margins can feel like a rather opaque process, but it is clear that margins came under pressure during 2022, as cost inflation ripped through the industry as a consequence of Covid re-openings and the war in Ukraine.

Let’s start with the cost equation. US diesel prices can be used as a proxy for mining production costs (i.e. transportation, energy, lubrication oils, etc). During 2022, through a combination of rising commodity prices and fears over a potential diesel shortage, we saw diesel prices surge, and this contributed to significant margin pressure for gold miners.

But with diesel prices falling (year-on-year), and higher gold prices, margins have recovered nicely, and this helps drive strong underlying cash flows. And that recovery is set to continue, given the recent surge in the price of gold, as well how diesel prices have fallen back further.

If we compare the annual change in gold (revenue) minus the annual change in diesel, we get a sense of how the tide is running, and its clearly running in the favour of gold miners. Interpreting Chart G below, we note that it’s not the height of the line that matters, but the surface area above it. We are currently in the longest and most extensive period of margin expansion for the sector in recent times, based on this (admittedly) basic analysis.

Why is this so important?

The bigger the area above the line, the greater the scale, scope, and duration of the margin expansion; and all else being equal, the bigger the boost to cash generation. Gold miners already have strong balance sheets and we know that shareholders don’t like the risks involved with starting new mining projects. And since that cash has to go somewhere, either back to shareholders or buying up existing gold miners, there has been significant industry consolidation in recent years, which seems likely to continue.

It seems, for now, an uncertain world and certain cashflows makes for an attractive combination.

https://www.collidr.com/app/uploads/2025/05/Collidr-Insights-Gold-Stocks-February-2024.pdf

Disclaimer: FOR PROFESSIONAL USE ONLY. This report was produced by Collidr Technologies Limited (“Collidr”). The information contained in this report is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment. While Collidr uses reasonable efforts to obtain information from sources which it believes to be reliable, Collidr makes no representation that the information or opinions contained in this report are accurate, reliable or complete. The information and opinions contained in this report are provided by Collidr for professional clients only and are subject to change without notice. You must in any event conduct your own due diligence and investigations rather than relying on any of the information in the report. Collidr Technologies Limited is registered in England and Wales No. 09061794. Registered office: Adler House, 35 36 Eagle Street, London, WC1R 4AQ, UK