2025 is likely to be remembered as a volatile year in financial markets. In the US, the first year of President Trump’s second term was filled with political, economic and geopolitical drama. The anti-immigration policies pursued by the Trump administration, alongside verbal attacks on the US Federal Reserve chair, Jerome Powell, have dominated domestic politics in the US.

The introduction and subsequent amendments or postponement of tariffs against US trading partners caused economic uncertainty. The US also dominated the geopolitical scene, in Gaza, Iran, Venezuela, and Ukraine. The Trump administration seems to be shifting the existing world order, which is creating a destabilising environment. Add to this, inflation in developed markets is higher than set targets, AI investment continues to increase, there is significant market concentration in the so-called “Magnificent 7” stocks, the high valuations in parts of the equity market, a US government shutdown that delayed economic data releases, gold rallying strongly and, overall, an atmosphere of uncertainty and higher volatility.

In the UK, economic concerns clouded the outlook. The run-up to the November budget created a period of uncertainty for investors. The political climate is also unsettling, both domestically and internationally. Despite this, the FTSE100 moved to all-time highs, buoyed by the rise in mining stocks and a recovery in the banking sector. In Europe, political tensions were also evident. Firstly, relations between the European Union and the US suffered, particularly over tariffs, but also over the war in Ukraine and President Trump’s designs on Greenland, part of the sovereign territory of Denmark. Secondly, domestic tensions were also present. None more so than France, where the government struggled to pass the budgets looking to cut the public deficit. In Germany, a substantial increase in fiscal expenditure was announced, as the country looks to increase defence spending. Europeans are looking at how a change to a new world order will impact them, particularly if the existing alliances that have kept Europe peaceful over the last 80 years start coming under scrutiny.

In Asia, they are also aware of the shift in the existing world order. China is, obviously, the main economic challenger to US dominance. However, the Chinese economy has not had the best of years. Consumer demand has weakened and there has been a property crisis in parts of the country, contributing to slowing growth. Despite this, China remains the dominant force in Asia and were the only major economy to take on President Trump’s tariffs in an escalating trade war in 2025, which caused the US to back down. In addition, China’s technological advances (e.g., the release of the AI app DeepSeek) continue, while tensions around China-Taiwan relations remain. In Japan, a new Prime Minister, Sanae Takaichi, is hoping to revive the “Abenomics” fiscal stimulus of a predecessor. While tensions between Japan and China remain, the Japanese economy is going through a structural change, experiencing consistent inflation for the first time in decades. As a result, the currency has weakened and bond yields are the highest for years.

Emerging markets have had a volatile but positive year. The threat of US tariffs has hit some countries hard, although a weakening dollar and a rise in commodities has pushed up equities. Emerging market countries are having to deal with a shift in the world order as well. An increasing reference to the Monroe Doctrine by the US administration puts pressure on South American countries to fall into the US sphere of influence. Similarly, African and Asian emerging markets are being drawn into the Chinese sphere of influence. Add to that, issues in the Middle East still persist. The shift in the world order is creating tensions, increasing geopolitical risks, and likely to create volatility.

Despite all of these risks and such a volatile year in terms of news flow, equity markets continued their bull run. After two years of around 20% returns, global equities (as measured by the FTSE World Equity/GBP) rose another 13%. Investors are aware of the risks but are continuing to invest. This is partly driven by investors deploying cash that has been sitting on the sidelines for some time (especially as interest rates decline and investors look to put that cash to work). Even though investors are aware that these risks may materialise further down the line, they want to stay invested in the short term.

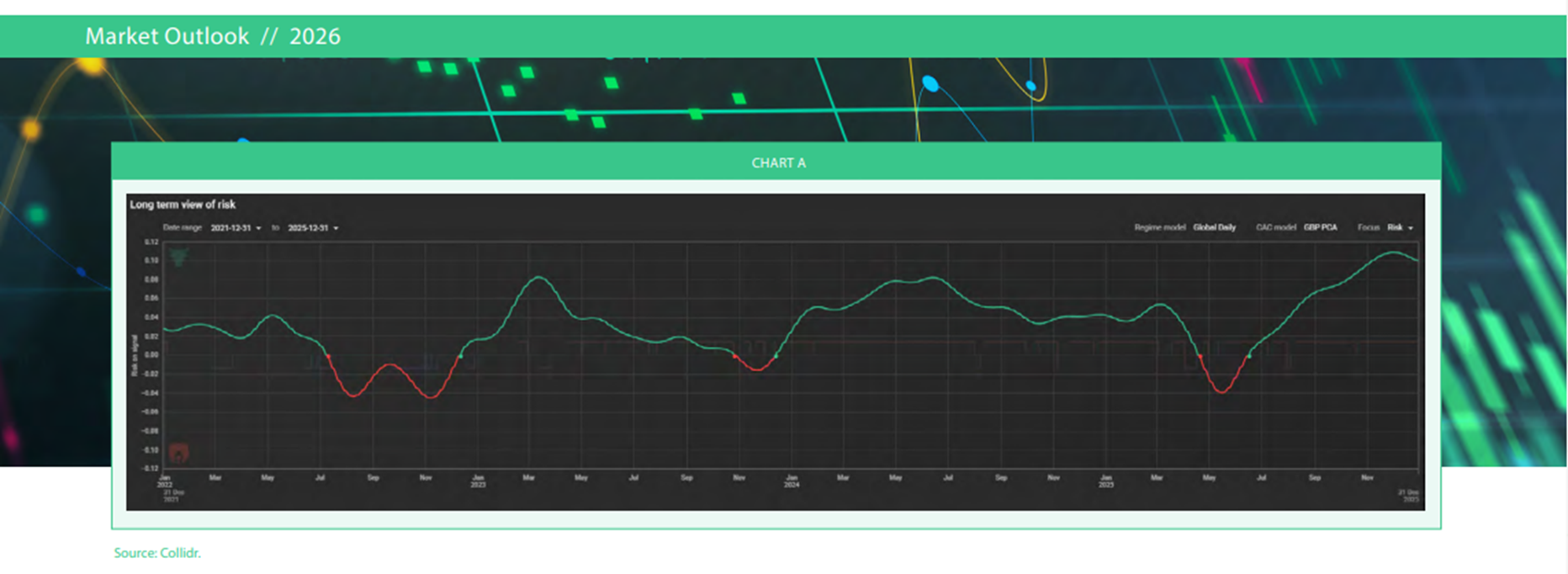

In such a volatile period, cutting through the short-term noise — which is often conflicting and confusing — and focusing on the longer term is essential. At Collidr, we prefer to use our proprietary, evidence-based, data-driven tools to monitor the evolution of the market environment, rather than attempt to predict future outcomes or precisely when these risks are likely to turn into a catalyst for a market correction. The tools allow our analysis to adapt to changes in the market, typically when new information comes to light, and to prepare for, and not guess, the risks ahead.

One of the tools we use helps evaluate the longer-term view of risk from a high level, top-down approach (CHART A). This tool fell into the bearish category between April and June last year, during the market correction following the tariff announcement by the Trump administration. However, the signal quickly moved back into bullish territory for the remainder of the year. Despite the volatility, it paid to retain a risk-on focus in 2025, and this tool indicated this.

This risk-on focus continues into 2026. However, we remain vigilant to risks that may lie ahead, particularly increasing geopolitical tensions. We believe risk levels should be maintained by managing through short-term market noise while remaining vigilant about the risks that inflection points may bring.

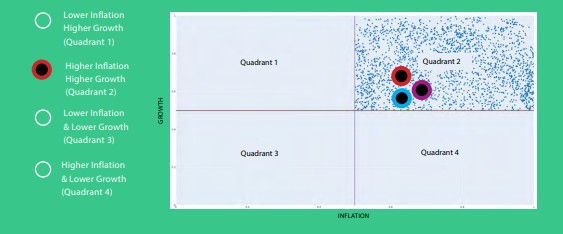

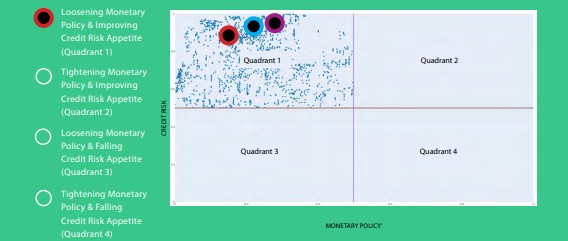

We also use macro economic quadrants to assist in analysing the current market condition set, including the asset classes most appropriate for these types of condition. Charts B and C reflect this analysis.

The US Federal Reserve (“the Fed”) reduced interest rates towards the end of the year, which was widely expected by the market. The Fed has a dual mandate related to inflation and employment in the US. Inflation is running slightly higher than the Fed target, but there is some softness in the employment data. This has resulted in the Fed cutting rates, albeit not at the rate that the US President would like, with our signals reflecting this by remaining in “Loosening Monetary Policy”.

We also remain in an “Improving Credit Risk Appetite” environment, reflecting the positivity in the quality part of the credit space. We remain in a “Higher Inflationary” environment, although the signals have been oscillating between “Higher Growth expectations” and “Lower Growth expectations”, indicating the uncertainty surrounding US economic growth, particularly following the US government shutdown that delayed the release of economic data. This analysis is purely data driven, so it reflects the current market conditions rather than any subjective view.

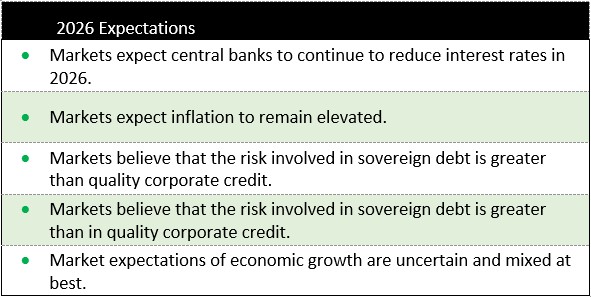

Moving this into a more practical context:

- Central banks loosened monetary conditions in 2025 and expectations are for further interest rate easing in 2026.

- The magnitude and direction of interest rate movements may change as economic data is released or, in the case of the US, if the soon- to-be-appointed Fed Governor turns out to be more in line with President Trump’s view of monetary policy.

- The US remains the key driver of the global economy. However, returns in 2025 were more diversified, with other regions, sectors, and value stocks staging a recovery or catch up. Performance was more broad based than in 2024.

- However, valuations (especially in US technology stocks) are at elevated levels on prospective AI earnings growth. Therefore, earnings announcements continue to be of particular importance.

- US tariffs have not led to an anticipated inflationary environment in the US – as companies are not, in the main, passing these costs onto consumers. That may change, and fiscal stimulus, from most of the developed markets, may also create inflationary pressures.

- The US mid-term elections in November looms on the horizon. The US President may revert to populist policies (such as the proposed 10% cap on credit card fees) to try to bolster support for his party, and retain control of Congress.

- Developed economies have increasing debt piles and any fiscal stimulus may only increase their debt. This may have an impact on bond markets, particularly at the long end of the curve.

- The move towards economic protectionism – as demonstrated by the use of tariffs – and away from globalisation is an increasing risk to economic growth.

- Economic data remains robust at present, especially in the US. Employment data has softened slightly. The risk of a “K” shaped recovery (where the rich get richer and the poor get poorer) is increasing and may have longer term impacts on economic growth.

- Geopolitical issues are increasing. The war in Ukraine continues. The US foray into Venezuela, the tensions in Iran, and the Greenland issue all remain unresolved. We are heading toward a new world order which raises the risk of policies escalating geopolitical tensions.

Overall

- Global equity indices had another strong year. While US large cap and technology stocks continued their strong run, 2025 was a year when other countries and parts of the market outperformed the tech sector. This was effectively these regions and sectors playing catch-up, as well as investors looking for more diversification. Therefore, it was a more broad-based performance than previous years.

- We expect this to continue in 2026, although we would not be betting against US equities or the technology sector at this point. The technology sector is still a substantial part of the US index. There is a large amount of capex being invested in progressing AI development and the earnings from some of the large technology companies are staggering. While their valuations may remain elevated, we still expect positivity in this sector.

- However, we do think that other parts of the market will continue to catch up against the technology sector. Defensive stocks, for example, have rallied on increasing defence spending and geopolitical risks. Mining stocks have grown as commodities have rallied. Therefore, we see benefit in having a diversified portfolio and not overly concentrated in the large cap technology sector.

- Other geographic regions have had a strong year in 2025 and we expect this to continue. Emerging markets have rallied on a weaker US dollar and increased commodity prices. Asian markets have also increased as China pursues its own AI development. Europe and the UK (particularly large cap) have increased. We expect this more broad based rally to continue and consider a diversified portfolio across regions to be optimal.

Currencies:

- The currency market is expected to remain volatile given the risks ahead. The US dollar has fallen against most major pairings in 2025, and this may continue if the dollar debasement trade remains. Furthermore, there has been a shift away from US-denominated assets by other parts of the world, for example, Emerging Markets, Middle East and China etc, as countries look to be more diversified in a world that is less US dollar centric. In addition, we have seen substantial moves in the Japanese yen which, given the currency’s traditional usage in finance in the carry trade, for example, may have an impact outside of Japan. Any substantial currency moves will increase volatility, which, in turn, could impact portfolio returns, unless currency exposure is controlled or hedged.

Investment Approach:

- Therefore, the question remains – where to invest? As we enter 2026, the 2025 playbook remains in force. A balanced approach seems optimal. While there are concerns about the high valuations of the technology sector, there is no guarantee that these valuations are incorrect, if the resultant earnings continue to back them up. Fiscal spending and a monetary easing policy may bolster equity returns. While it is important to remain aware of the risks and be vigilant to inflection points, the risk-on environment remains and a diversified portfolio is suggested.

- We expect to retain a substantial allocation to the US, but maintaining a balance within that exposure – between growth, value, sector, and capitalisation biases.

- Outside the US, we think a balanced exposure between different geographic regions, maintaining allocations to assets that are likely to benefit from inflationary environments, such as commodities, is prudent.

- We expect to have a large allocation to Asian and Emerging Markets exposure. This part of the market can benefit from diversification away from the US, especially in the technology sector in Asia. Emerging Markets should also benefit from a weakening dollar, commodity price increases and the parts of this market that have sound economies. We expect Japanese equities to react positively to any potential fiscal and monetary stimulus measures introduced following the early election in February.

- We retain an exposure to Europe and UK, although mainly with a large cap, quality focus for the time being. We believe that increased debt levels in this part of the world may impact economic growth, which is likely to affect smaller capitalisation companies more than the larger, internationally-focused companies.

- In the thematics, we retain an exposure to technology stocks as the AI story continues to develop. We also like the defence sector on increased geopolitical tensions. Finally, we retain an exposure to mining stocks, following a strong rally. We believe there may be further to go on the precious metals trade, and the valuations of the mining sector have yet to fully reflect the large moves in metal prices.

Fixed Income

Fixed income markets generally had good returns in 2025. There were some parts of the market that struggled, for example Japanese Government Bonds, where yields increased to their highest ever levels at some tenures. Correlation between equities and fixed income remains at elevated levels, so it is imperative to ensure diversification. Risks do remain, however, should inflation start to pick up, or if developed economies debt levels increase. Saying that, we remain constructive on credit and do see pockets of value in the fixed income space.

Government Bonds

- In the sovereign space, we see some risks ahead. Increasing levels of debt in developed economies has raised yields. Fiscal spending from some developed economies (for example, the One Big Beautiful Bill in the US, and the proposed tax changes in Japan) may put some pressure on the longer end of the curve in government bonds. The direction of the Fed decision will come under scrutiny with the announcement of a new chair of the committee in the first half of the year.

Corporate Bonds

- In the investment grade space, we continue to see opportunities in debt issued by ‘quality names’, for example, strong established companies with substantial and stable cash flows. If there is economic stress in the system, quality names should continue to repay their debt, so there will be reduced default risk. Even though credit spreads remain at tight levels, quality corporate credit is preferable to sovereigns due to having better balance sheets. For even more protection, look at the short-duration section of the market.

Money Market

- Should yields continue to fall, we would expect outflows from money market funds as capital looks to get better return elsewhere. However, they still do provide decent yields with lower volatility risk.

High Yield

- The high yield space continues to perform well, particularly with short duration. So maintain exposure here particularly in quality high yield names at the shorter end of the curve to reduce duration and default risk. However, be vigilant of risks in this part of the bond market.

Other Asset Classes

As volatility increases, be vigilant of increasing correlations between equities and fixed income. Commodities have had a strong year, especially precious metals, and this is likely to continue in 2026. Alternatives can also improve portfolio diversification. We expect these asset classes to continue to provide diversification benefits, adding improved risk and return sources, as well as the potential to perform should conditions deteriorate.

Given that risks remain as conditions evolve, we continue to see alternatives as a way to help stabilise returns in a correction or highly-volatile environment.

- Commodities – commodities have been, and continue to be, in focus. Gold and other precious metals could continue to rally on geopolitical risks. If an inflationary environment returns, commodities can provide some protection and additional diversification.

- CTAs – In situations where volatility remains elevated, we think that Commodity Trading Advisor (CTAs) or trend following funds are a useful tool, as they add low to negative correlation to the main asset classes. Although position sizing becomes important, as large positions in CTA’s have the potential to dominate returns.

- Long/short equity and bond funds – These funds, run by good managers, can help provide positive/low volatile returns in these type of market environments, adding positive performance and limiting downside volatility.

- Currencies – finally, there may be opportunities in currency markets, especially as we expect an increase in currency volatility. In this type of environment, there may be opportunities for currency strategies, although explicit and successful currency strategies are few and far between. We would expect good global macro managers to be able to exploit any potential returns here. In addition, there will be look-through benefits to other asset classes, such as emerging markets, should the US dollar debasement trade continue.

Disclaimer

The information contained in this document is for informational purposes only and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment, and examples used are for illustrative purposes only. This document provides commentary and data on global markets and does not provide any reference to specific products and should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment in any jurisdiction. While all reasonable efforts are made to obtain information from sources which are accurate at the date of production no representation is made or warranty provided that the information or any opinions contained in this document are accurate, reliable or complete. The information and any opinions contained in this document are based on current market conditions and certain assumptions and are subject to change without notice. Any user must, in any event, conduct their own independent due diligence and investigations, together with their professional advisers, into legal, regulatory, tax, credit and accounting matters before making any investment, rather than relying on any of the information in the document. The value of investments and the income from them can go down as well as up and past performance is not a guide to future performance. This document is issued by Collidr Asset Management Ltd which is authorised and regulated by the Financial Conduct Authority (713361) and is registered in England and Wales. Company No. 09061794. Registered office: 35-36 Eagle Street, London, WC1R 4AQ, UK.

Sources: Collidr, Bloomberg. Indices: Barclays, FTSE, Bloomberg, STOXX, Japan Exchange Group, MSCI, S&P, New York Mercantile Exchange, Chicago Mercantile Exchange, Bureau of Labour Statistics, US and Office for National Statistics, UK.